Retiring

This is Your Year to get Financially Fit

Knowing what you want in life - a bigger house, a new car, financial freedom to do the things you want, or a comfortable retirement when you're ready - well that's the easy part.

Figuring out just how to get there is where the challenge comes in. But with a little know-how and a well-laid plan, achieving your goals is possible. You just have to know where to start and be willing to do the work to get the results you're after. Just like getting in shape physically.

IT ALL STARTS WITH A PLAN.

While a cool million might be on everyone’s retirement wish list, it might not be an achievable reality for you, or even necessary for that matter. That’s why the first step is an important one, SET REALISTIC GOALS.

Don’t just say “I want to retire someday with a lot of money”, MAKE YOUR GOALS MEASURABLE. Determine how much you need and when you want to have it. For example, “By the age of 65 I will have $300,000 in my investment portfolio for retirement”.

So what’s in your retirement portfolio? BE SPECIFIC. Registered Savings Plans like a TFSA or RRSP complement one another perfectly as they give you both short-term and long-term options. As both are eligible for a range of investments, including term deposits, you’ll have maximum flexibility depending on your timeframe and risk level.

Now you can break it down into the steps you need to take to get you there. CREATE AN ACTION PLAN. This is where our expert Financial Advisors can help by looking at your entire financial picture to determine the products that will be right for you and your needs.

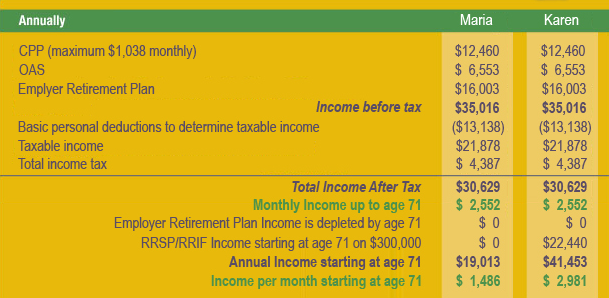

While your strategy will vary greatly from someone else’s, seeing a winning strategy in action can sometimes be a great motivator. Below are two examples of a member’s financial picture at retirement, showing how mindful planning can make all the difference in helping you achieve “retirement readiness”.

Maria has earned $60,000 annually for the past 10 years. When she began her career in 1984, she earned $30,000 annually which increased to $40,000 in 2004. During that period, her employer contributed 5% of her annual income to her pension, which totaled $94,046 when she retired. Maria didn’t contribute to her pension plan nor did she save additional funds to augment her retirement income.

Karen’s situation is similar to Maria’s in all respects except she saved $300,000 over the years to ensure that she could maintain her current lifestyle after her pension plan was depleted at age 71. In order to accumulate $300,000 in RRSPs at an average of 5% return on investments, Karen saved $368 monthly for 30 years.

While the above examples are vast generalizations for illustrative purposes only and likely do not totally represent your own circumstances, they do present some of the factors you need to consider when planning for retirement.

With a little planning, some well-placed effort and a bit of encouragement along the way, you can get financially fit and stay there. We’ll be with you every step of the way and we’re here to offer the motivation you need to reach your goals again and again. Think of us as your personal trainer for staying financially fit year after year.

Contact us to discuss your goals today!